Decoding Mortgage Underwriting

Hey there, soon-to-be homeowner! Let’s dive into the world of “Underwriting” - it’s the behind-the-scenes magic that makes your mortgage happen. Here’s the scoop:

What’s Underwriting?

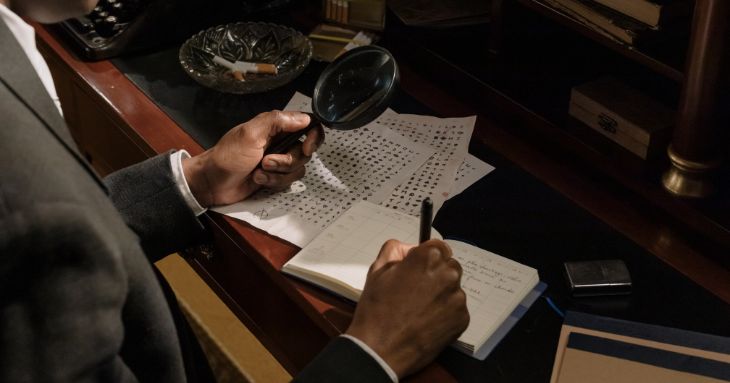

Underwriting is like the detective work of mortgages. It’s the process where a lender assesses your financial fitness to determine if you qualify for a home loan.

The Underwriter’s Checklist

Your underwriter reviews your credit score, income, assets, and debts. They ensure you meet the lender’s criteria and assess the risk of lending to you.

Dotting I’s and Crossing T’s

Your application and financial documents are scrutinized. The goal is to confirm you can make your mortgage payments and manage other financial responsibilities.

The Final Decision

After a thorough analysis, the underwriter makes one of three decisions:

- Approval

- Conditional Approval

- Denial

It’s a Team Effort

Your loan officer, realtor, and others work together to provide the underwriter with the info they need. Remember, patience is key during this process! The underwriter’s goal is to protect both you and the lender.